I get it—accounting can seem as dry as the Sahara, and accountants are often thought to have a similar temperament (although there are exceptions, ahem!). Numbers, spreadsheets and accounting methods might not be everyone’s cup of tea, but in my role as a Financial Management Consultant, they’re the spices that add flavor to my cup of tea.

When I chat with senior leaders in nonprofit organizations, I’ve noticed that puzzled looks often arise when I ask them whether their organization follows the cash method or accrual method of accounting. This is followed by the inevitable question: “What’s the difference between the two?”

Well, fear not, dear nonprofit visionaries! This blog is here to save the day. By the time you finish reading, you’ll be well-equipped to discuss accounting methods with confidence and tell your accountant, “I’ve got this!”

We’ll start with the easier of the two methods.

Cash Method

The cash method is like the piggy bank method. You record revenues when cash comes into your piggy bank and expenses when cash goes out. It’s pretty straight forward.

So, why would not all organizations follow this method? Paradoxically, it’s this simplicity that makes it untenable for larger organizations. Furthermore, specific compliance related issues necessitate organizations to follow the accrual method of accounting. We won’t be getting into those intricate details here. For now, let’s focus on numbers and accounting. I’m an accountant after all!

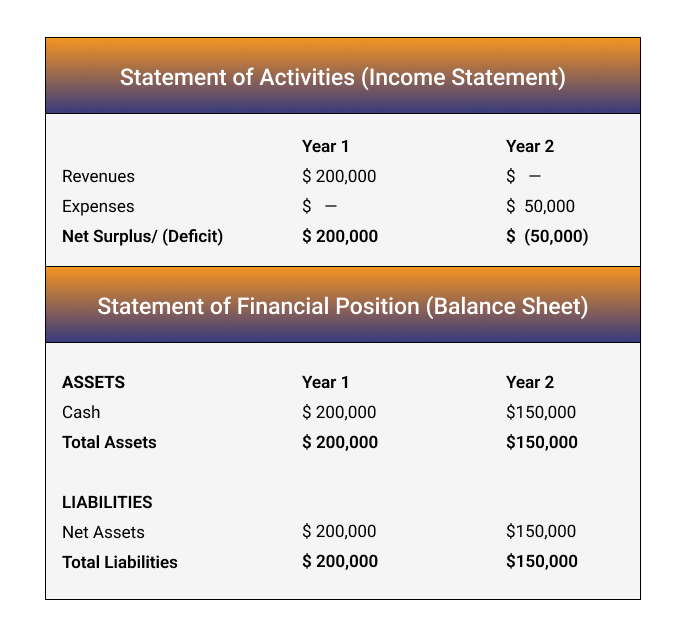

In this piggy bank method, say your organization received $200,000 for services that it will provide over two fiscal years. Since the entire $200,000 has come into the piggy bank (don’t worry—the piggy bank is large enough to hold this amount), you will record the entire $200,000 as revenues for the first year.

This is awesome when you see the financial results of Year 1, but it’s not so great when you see $0 in revenues for the second year. On the expenses side, say that your organization received an invoice for $50,000 for supplies and postponed payment to the second year. In this case, the organization’s Year 1 financials will show $0 as expenses, and Year 2 will show expenses of $50,000.

This gives a very skewed view of the financial results of the organization: a surplus of $200,000 in Year 1 and a deficit of $50,000 in Year 2 as illustrated below.

Let’s take it a step further. Imagine you presented these financial results to your Board (overlooking the $50,000 you still need to pay to vendors in Year 2), and they ended up approving a new program that required an investment of $200,000. Your organization is in for some serious challenges!

It may sound improbable, but it’s entirely possible. Since all the financial information on the advances and payables is not recorded in one place, it becomes difficult to make long-term decisions or know how the organization is really performing in any given year.

This, in addition to compliance requirements (such as if your organization earns more than the threshold revenues, receives federal grants over a certain threshold, etc.) is the reason that larger nonprofits adopt the accrual method of accounting.

Accrual Method

The accrual method of accounting is definitely more complex than the cash method. The piggy bank (i.e. cash flows) is only one portion of an organization’s recordkeeping.

The accrual method is guided by the Generally Accepted Accounting Principles (GAAP). Before digging into the accrual method, let’s talk for a brief moment about GAAP.

Now, you might be wondering, ”What’s so important about GAAP, and why should my nonprofit care about it?” Great question! GAAP is the standard for financial reporting in the United States. It ensures that there is consistency, transparency, and trustworthiness in your financial statements.

By following GAAP, you’re not only keeping your donors, grantmakers, and regulators happy, but you’re also boosting your nonprofit’s reputation as a credible, transparent, and accountable organization. Plus, don’t forget that external audits and certain reporting requirements mandate GAAP-compliance.

Now back to the accrual method. Let’s consider two crucial GAAP concepts that govern its workings: the revenue recognition and the matching principle.

Revenue Recognition Principle: This principle directs us to record revenue when it is earned, regardless of when we receive the actual cash. Picture this: your nonprofit hosts a fundraiser and collects pledges for donations. The accrual method dictates that you recognize the revenue as soon as the pledges are made, even if the check is sent in later. In essence, it’s like saying, “A promise is as good as gold!”

Matching Principle: This guiding star mandates that we record expenses when they are incurred, not when we pay them. Imagine your nonprofit hires a consultant for a project, and they send you an invoice for their services. According to the accrual method, you’ll record the expense when you receive the invoice, not when you write the check. In other words, “An expense is an expense, whether paid now or later!”

By adhering to these GAAP principles, the accrual method provides a more accurate and comprehensive picture of your nonprofit’s financial health. It enables you to track revenues and expenses in the same accounting period, providing a clear view of your organization’s performance over time.

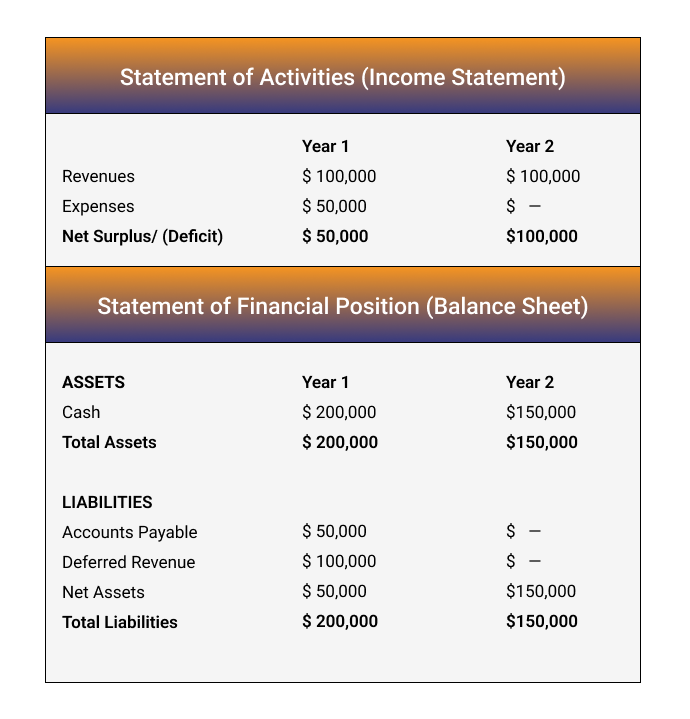

Now let’s use the same example we used in the cash method to see how our financial statements will appear under the accrual method.

As you can see, this method shows more nuanced and detailed information about all the resources that your organization owns as well as all your obligations. You are clearly not going to forget the $50,000 that you owe to your vendor for supplies or the fact that you still need to provide services for $100,000 in the next fiscal year.

This is why funders and other decision-makers prefer (and in many cases, require) organizations to use the accrual method of accounting.

Advantages and Drawbacks

Now that we have both the methods down, what are some of their pros and cons?

Cash Method

Pros:

Simplicity: The cash method is the very embodiment of “cash in, cash out.” With its straightforward approach, it’s easy to understand and manage, making it ideal for small nonprofits or those with limited resources.

Cash Flow: This method provides a clear picture of your organization’s cash flow, as you only record transactions when cash is received or paid. This makes it easier to track available funds and manage short-term financial needs.

Cons:

Inaccurate Financial Picture: The cash method can obscure your nonprofit’s true financial performance, as it doesn’t always align revenues and expenses with the period in which they were earned or incurred. This can lead to unsound decisions, especially when planning for the future.

Not GAAP Compliant: The cash method isn’t compliant with GAAP, which could be an issue for nonprofits that require external audits or must adhere to specific reporting standards.

Accrual Method

Pros:

Comprehensive Financial Picture: By recognizing revenues and expenses when they’re earned or incurred, the accrual method provides a more accurate representation of your nonprofit’s financial performance, allowing for better decision-making.

GAAP Compliance: The accrual method aligns with GAAP, ensuring consistency and transparency in financial reporting. This is particularly important for larger nonprofits or those subject to external audits or strict reporting requirements.

Cons:

Complexity: The accrual method is more complex than the cash method. This might necessitate additional resources or expertise for accurate recordkeeping.

Cash Flow Management: Since the accrual method focuses on earned revenue and incurred expenses, it doesn’t directly reflect cash flow. This can make it challenging to monitor available funds for day-to-day operations or short-term financial obligations.

Now, if your organization is currently using the cash accounting method and would like to convert to the accrual method, there are a few things to consider. These include notifying the IRS on the change in method, providing additional staff training on the new method, communicating with the Board about the change and reasons for change, determining the impact of the change on your financial statements, etc. This is an area in which you should consider engaging a Certified Public Accountant to guide your organization through the conversion process.

And there you have it, a walk through the realms of cash and accrual accounting methods, with the pros and cons of each approach. Armed with this knowledge, you are now better equipped to assess which accounting method will help your nonprofit organization flourish.

Remember, the ultimate goal is to find the method that best aligns with your organization’s needs and resources, ensuring that your financial reports accurately reflect your financial story.

Need support figuring out which accounting method is best suited for your organization? Reach out to our Financial Management team for a free consultation.

Here’s to a future filled with financial acumen, sound decision-making, and boundless success for your nonprofit organization!

Additional Resources

Information on revenue thresholds for audit for California nonprofits

Information on Single Audit for organizations expending Federal Funds