As the COVID-19 crisis continues, many nonprofits are trying to figure out how they will pay ongoing operating costs, including rent.

At the same time, local governments across California responded by enacting eviction moratorium ordinances that allow small businesses and nonprofits to avoid eviction if they are unable to pay rent due to COVID-19. However, these eviction moratorium ordinances do not wave rent payments and do not provide guidance on how to address missed payments. Instead, landlords and tenants are expected to negotiate agreements to address rent repayment or, in some cases, forgiveness.

Through our Rapid Response Technical Assistance program, our staff have helped numerous nonprofits navigate these difficult discussions with landlords over the last two months. Based on this experience, we would like to share the following strategies and observations as a resource to help nonprofits negotiate a modified rent agreement with their landlord.

Identify your organization’s financial situation. Prepare a 3 to 6 month cashflow forecast that takes into account:

- Lost revenues

- Grants and loans you can reasonably expect to receive

- Cost saving strategies

- Rent abatement vs. deferment options

Make sure to include not just the impact of sheltering in place, but also assume a ramp-up period before the organization’s operations stabilize. Also, include any debt service for non-forgivable loans. It is also good to be conservative and assume that some revenues, such as events, will not come back for a long period of time (the new ‘normal’ will not be like the old ‘normal’).

Given the high level of uncertainty for many of the variables, you may need to run different scenarios.

The goal is to be able to methodically talk the landlord through:

- The organization’s detailed survival budget plan;

- Outreach to grant/loan/new funding sources;

- Any hard decisions (made and to-be-made) that may come in to play; and

- What type of support the tenant is requesting from the landlord.

Negotiate with your landlord based on the demonstrated needs. Negotiate in good faith. The goal of negotiating with your landlord should not be to get 100% rent abatement, but rather to reach an agreement that permits your organization to continue operating through the crisis and recovery, and also allow the landlord to cover as much of its costs as possible.

An organization we work with started by offering to pay the Common Area Maintenance (CAM) costs, which is approximately 10% of the total rent. The landlord initially responded with a request for immediate full payment. A few weeks later, the landlord came back and offered 50% rent deferment if the organizations are able to get emergency funding or 50 percent rent forgiveness if they are unable to secure funding. In another case, a landlord offered rent forgiveness for two months, in exchange for two additional months to be added at the end of the lease.

Potential options for negotiating with your landlord, include:

- Decrease rent by a certain percentage for a number of months

- Defer rent for a number of months

- Structure rent payment as a percentage of net revenue

- Extend lease to offset rent abatement and/or deferment

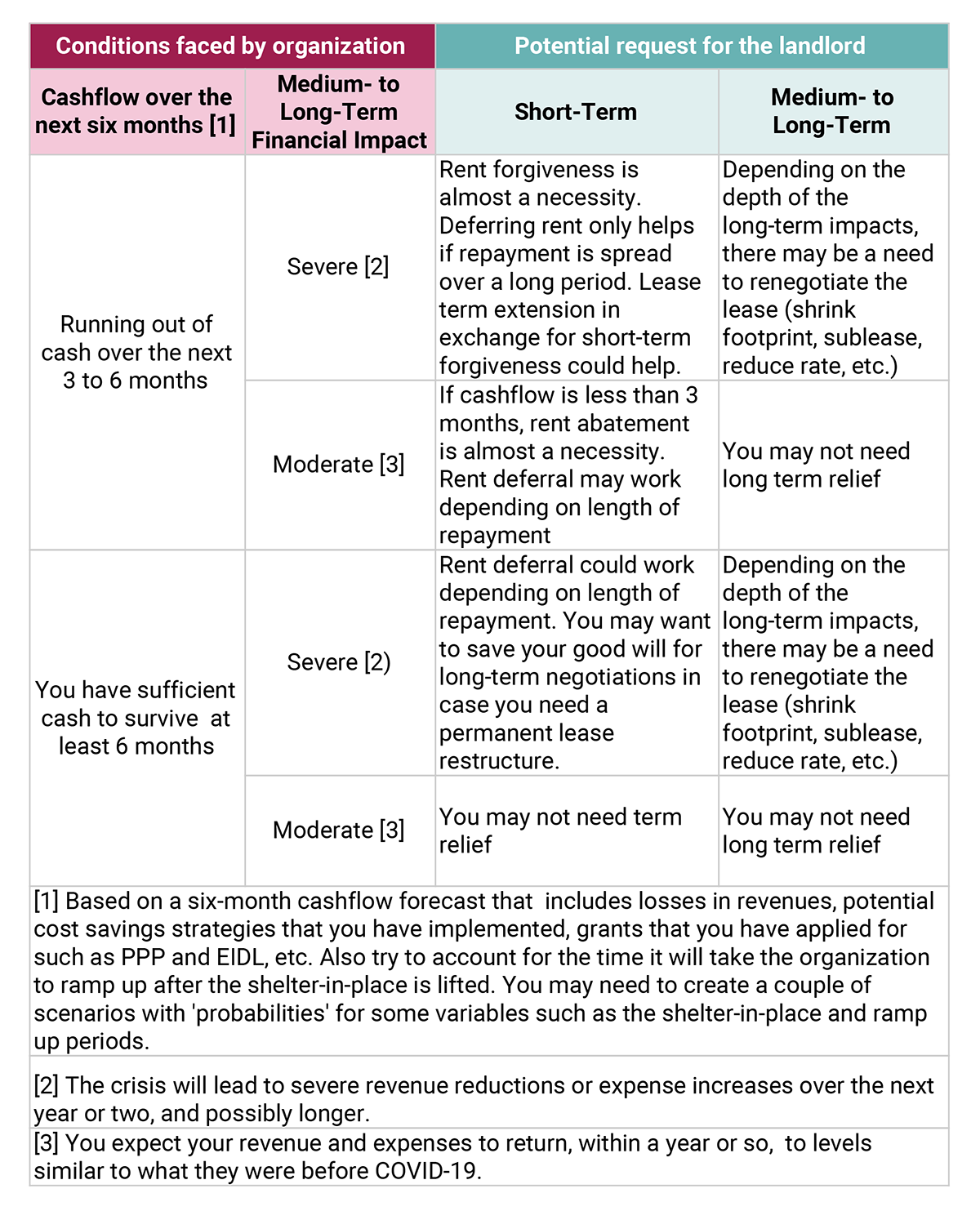

The diagram below illustrates potential negotiation approaches depending on the financial situation faced by your organization. It should also be noted that the period remaining on your lease may impact your leverage. If you are on a month-to-month lease or have less than a year in your lease, you may have more leverage in the negotiations as landlords will have an interest in keeping you as a tenant through the recovery.

Know your rights. Although it is better not to play hardball, it is good to know that many cities prohibit commercial evictions because of nonpayment if you can demonstrate that COVID-19 severely impacted your revenues. See for example the San Francisco eviction moratorium. However, most of these moratoria do not release tenants of their rent obligation, so it is important to continue negotiating with your landlord even if you cannot make rent payments during this period.

Remember, to be protected by an eviction moratorium you will probably have to demonstrate need. This is why #1 above is important.

Involve a lawyer (at the right time). You should enlist a lawyer to review your lease and vet communications with your landlord to ensure you are not exposing yourself to anything legally. It is better to have a lawyer review your communications, but continue communicating directly with the landlord (rather than through the lawyer). Only get the lawyer directly involved when absolutely necessary (i.e., drafting a lease amendment, etc.) The following resources may help if you do not already have a lawyer in your team.

- For Bay Area Organizations: Lawyer’s Committee For Civil Rights’ (LCCR) Legal Services for Entrepreneurs Program, 415-543-9444 x217, lse@lccrsf.org

- For San Francisco Organizations: Bar Association of San Francisco’s Conflict Intervention Service 415-782-8940

In some instances, Community Vision may be able to make lawyer referrals for mission-aligned organizations.

Prepare for protracted negotiations. At this point, everybody is in waiting mode. There are many unknowns; which tenants will be able to get operating grants; which landlords will get loan extensions; how long will the shelter-in-place remain, etc. As information emerges, both parties will be better positioned to reach a satisfactory deal.

Finally, it can be demoralizing (or maybe encouraging) to hear that other people and organizations are getting 50%, 75%, 100% rent abatement, but it is important to remember that every case is different. Some landlords are carrying significant debt, some may have had business income loss insurance, etc. The best we can hope for is to reach an agreement that is tailored to the circumstances faced by your organization and your landlord.

Community Vision is here to support your organization through these times. If you need help navigating this uncertain terrain, please check out the recording of our “Tenants’ Rights” Leasing Webinar, which provides detailed information on this topic. You can also setup a free 45 minute call with one of our expert consultants for some direct assistance.