This article is part of a series celebrating Community Vision’s 35 years of building partnership, capital and power to advance community ownership of community assets. Learn more.

Bay Area Racial Equity Fund

In October 2020 American Nonprofits, Community Vision and Nonprofit Finance Fund joined forces to launch the Bay Area Racial Equity Fund (BayREF).

The aim was to support leadership and power building in BIPOC communities, who continue to be hit hardest by the pandemic, through reparative capital and strategic financial advising.

BayREF provided free technical assistance and access to 0% working capital loans for BIPOC-led organizations with budgets under $3 million. BayREF’s offerings began in Spring of 2021 and have since moved more than $2 million to BIPOC-led organizations.

- BayREF’s 0% interest loans ranged from $15k to $250k with no application fee and no collateral or guarantees. Flexible repayment plans were tailored to each borrower.

- BayREF’s technical assistance supported client board members, executives and program staff on a wide variety of financial topics such as budgeting, forecasting and financial reporting.

- BayREF’s offerings were made possible with support from The California Endowment, Stupski Foundation and Silicon Valley Community Foundation.

As of July 2022, all of the BayREF funds have been successfully dispersed. As the loans provided through this initiative are repaid over the next 2-3 years, we will continue to engage, support and learn from our BayREF clients.

BayREF demonstrated an urgent, ongoing need for no-cost, flexible capital and a desire for financial training and advising among BIPOC-led organizations.

The BayREF program is just the beginning. Community Vision is continuing to work with our partners to raise funding for new initiatives like BayREF that support additional capital deployment and financial training.

The “post-pandemic” economic recovery is uneven and its ongoing impacts remain urgent in Black and Brown communities.

- Organizations serving BIPOC communities pivoted their services to operate in the first waves of the ongoing pandemic, expanding programs and filling the gaps left by ineffective government policies and systems. For these organizations, the COVID waves were tsunamis within the BIPOC communities they serve.

- BIPOC-led organizations launched food banks, mutual aid programs, became COVID testing and vaccine centers and served as multilingual information hubs. These new activities stressed organizational budgets and depleted reserves that were hard won, especially for small and medium nonprofits. They achieved their mission to serve their communities in crisis at a financial cost, rapid depletion of financial reserves that enabled them to be responsive during multiple emergent crises.

- Other organizations working in BIPOC communities continue to see dwindling resources to meet rising needs for their services in health care, education, affordable housing, food, job stabilization, youth and seniors, etc.

- Many BIPOC-led nonprofit organizations whose programming centers around facilities–museums, performing arts venues and community centers–remain closed or have not recovered to pre-pandemic levels.

- BIPOC-led organizations that advance movements and advocacy are working hard to ensure that there is no “return to normal” that led us to these disparities in the first place. Instead they are charting a course of systemic change that will help ensure that when the next crisis or pandemic hits, history will not repeat itself again.

BayREF demonstrates that BIPOC-led community-based organizations want increased partnerships and flexible capital to face the challenges of this moment and the future.

Demand for Loans:

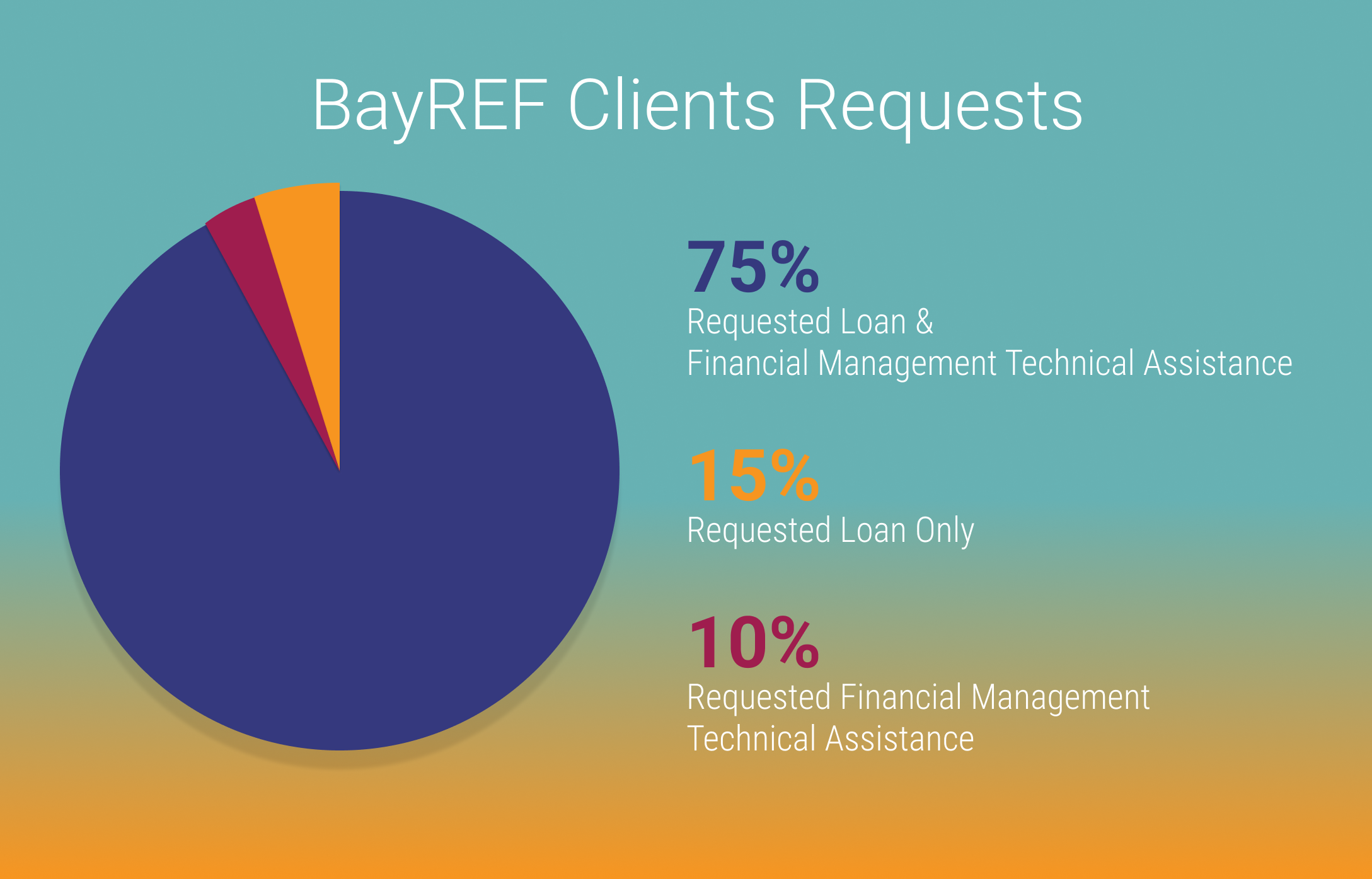

- Lenders received a total of 71 applications for loans, representing $9.8 million in the aggregate. This includes 51 organizations that requested both loans and financial management technical assistance. This demand far outweighed the funds available through BayREF nearly 4:1.

- Lenders approved a total of $2.1 million of 0% interest, no cost loans to 17 organizations. Loan amounts ranged from $15,000 to $250,000, with an average of $124,400.

- Loans were used for working capital and liquidity (64%) followed by facilities and equipment (24%) and program expansion (12%).

Demand for Financial Management Technical Assistance:

- Lenders received requests for financial management technical assistance and advising from 62 organizations, with 51 seeking technical assistance in conjunction with a loan and 11 organizations that inquired about technical assistance but were not interested in a loan.

- The most often requested financial management technical assistance included financial projections, cash flow management, board financial training and financial dashboards.

- Lenders completed 365 hours of financial training with a total of 30 organizations.

To learn more about BayREF contact Risa Keeper at rbkeeper@communityvisionca.org

To learn more about Community Vision’s lending program visit Capital Solutions

To learn more about Community Vision’s advising services visit Real Estate Solutions

To learn more about American Nonprofits visit https://www.americannonprofits.org

To learn more about Nonprofit Finance Fund visit https://nff.org