“Wait! A noncash expense? What does a noncash expense mean? Shouldn’t an expense mean that cash is paid for it?”

These are common questions I often get asked when I talk about depreciation when working with nonprofit organizations. Depreciation, a noncash expense is a well-known concept to trained accountants. But I’ve come to realize that it’s a concept that often creates confusion for those who are not involved in the weeds of accounting.

This blog will cover the concept of depreciation, the accounting rules relating to it and how including depreciation as an expense in your budget can lead to getting more money for your programs from funders. This is especially important if you as nonprofit check the box on any of the following:

- Own a building or are thinking about buying a building;

- Thinking about making leasehold improvements, renovations; or

- Own FFE (furniture, fixtures, and equipment).

So, let’s start at the very beginning, a very good place to start (as a fan of Sound of Music, I couldn’t resist making this reference!!)

Methods of Accounting

The two primary methods of accounting are the cash method and the accrual method. Before getting into the specifics of both the methods, it is important to note that depreciation is recorded only under the accrual system of accounting.

Cash method

Under the cash method, revenue is recorded when cash is received, and expenses are recorded when cash is paid. What matters is when the money comes in or goes out of the organization. Most small organizations use this method.

Accrual method

Under the accrual method, revenues are recorded in the period in which it is earned (revenue recognition principle) and expenses are recorded in the same period in which the corresponding revenue is earned (matching principle). It does not matter when the cash is received or paid.

Accounting for transactions under both the methods

The following example will show the difference between the two methods for the same set of transactions.

Scenario:

An organization receives $250,000 in Year 1 for workshops that will be held evenly across two years. It also receives an invoice for $100,000 for repairs in December, Year 1, which it pays in Year 2. The organization’s fiscal year is from January to December.

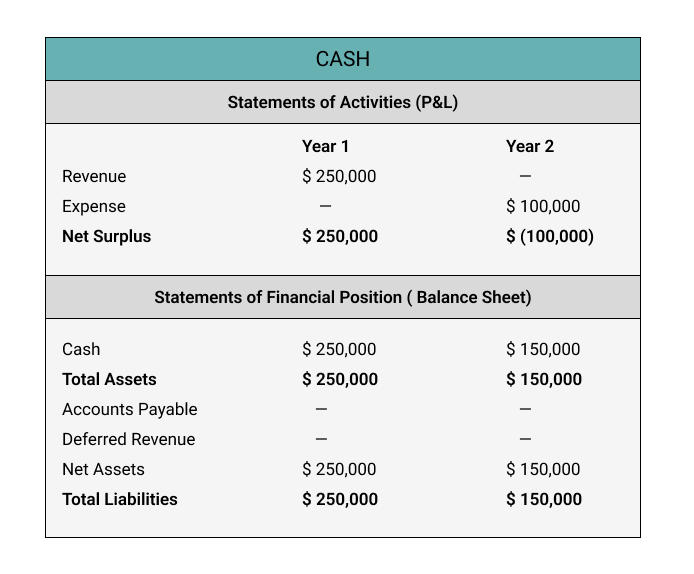

Accounting under the cash method

Since the cash is received in Year 1, the entire amount is shown as revenues in Year 1. No expense is recorded since no cash has been paid for the expense, and hence this organization will show a net surplus of $250,000 in Year 1. In Year 2, the organization will record $100,000 as expenses, since Year 2 is when the cash is paid, and will have $0 revenues. So the net deficit for Year 2 is $100,00.

The financial statements will be as shown below.

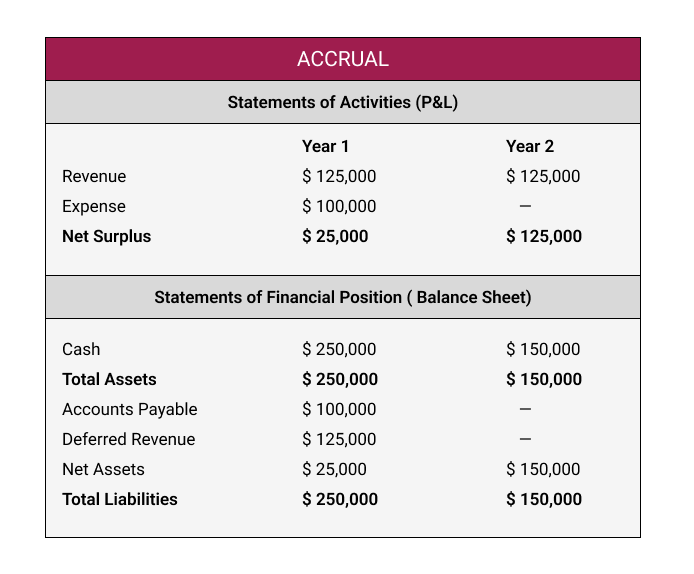

Accounting under the accrual method

The revenues will be split evenly across the two years (since the workshops are held evenly across two years). Hence, Year 1 and Year 2 revenues will be $125,000 each. Since the invoice for the expenses incurred is received in Year 1, expenses of $100,000 will be recorded in Year 1, thereby netting a surplus of $25,000 in Year 1. In Year 2, the organization will have a surplus of $125,000. The financial statements will be as shown below.

Clearly the operational results under both the methods are very different. Further, there is no additional information such as accounts payable or deferred revenue in its Statement of Financial Position under the cash method. Therefore, insights into these account balances will be unavailable unless adequate records are maintained elsewhere.

Clearly the operational results under both the methods are very different. Further, there is no additional information such as accounts payable or deferred revenue in its Statement of Financial Position under the cash method. Therefore, insights into these account balances will be unavailable unless adequate records are maintained elsewhere.

Generally Accepted Accounting Principles (‘GAAP’)

GAAP prescribes the accrual method of accounting. GAAP is the common set of principles, standards issues by the Financial Accounting Standards Board (‘FASB’). GAAP applies to both, for profit and nonprofit companies. These standards cover all topics related to compilation and presentation of financial statements, including recognizing contributions, treatment of leases, and to the current topic, i.e., depreciation. Hence, organizations following the accrual method should account for depreciation as prescribed by GAAP.

Let’s get into details of what depreciation means, how to calculate it, the impact of depreciation on an organization’s financial statements, and how recovery of depreciation expense in program budgets can lead to increased revenues for organizations.

Depreciation per US GAAP

The meaning of depreciation per the Cambridge English Dictionary is that it is the process of losing value. Under GAAP, depreciation is defined as a system of accounting that aims to distribute the cost of a tangible capital asset less the salvage value if any over its estimated useful life in a systematic and rational manner (yes – accounting jargon makes everything sound more difficult than it is!). Let’s break down the definition into digestible parts.

- Cost of tangible capital asset: Before determining what constitutes costs of tangible capital assets, it is important to know what constitutes capital assets. Capital assets are assets used in an organization’s operations to generate revenues over more than one year. Assets that have a finite value and are usually in a physical form such as buildings, machinery, equipment, furniture, etc. are tangible capital assets. The costs of acquiring a tangible capital asset includes the costs necessary to bring the asset to a condition and location necessary for its intended use.

- Salvage value: It is the estimated value of an asset at the end of its useful life.

- Useful life: This is the period over which the asset is expected to contribute directly/indirectly to future cash flows. There is no prescribed useful life as it’s up to the management to come up with a policy regarding useful life of its assets.

- Method of depreciation: There are a number of depreciation methods prescribed by the Accounting standards such as the straight-line method, declining balance method, sum of year’s digits, and units of production. But the most common method is the straight-line method.

In this blog, we’ll focus on the straight-line method since this is the most commonly used method by organizations.

Straight line method example

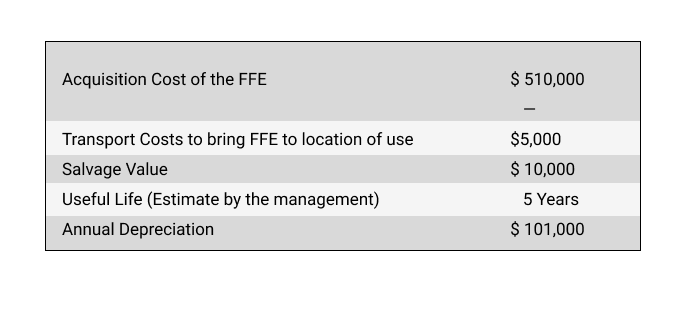

Let’s now calculate depreciation under straight line method for the following example.

Annual depreciation = (Acquisition Cost* – Salvage value)/Estimated Useful life

Annual depreciation = (Acquisition Cost* – Salvage value)/Estimated Useful life

($510,000+$5,000-$10,000)/5= $101,000

*The costs of acquiring a tangible capital asset includes the costs necessary to bring the asset to a condition and location necessary for its intended use. So, if you purchase equipment for use in a facility, the transport costs to bring the equipment to your facility will also be added to the purchase price to determine the cost of the equipment purpose.

Based on the management’s estimate that the useful life of the FFE is five years, the annual depreciation expense is $101,000. Connecting this to the accrual method, it means that the organization needs to record an expense of $101,000 every year for a period of five years, since it’s incurring this expense in using the FFE to generate revenues over the useful life of five years. The allocation of the cost of the FFE over five years can be shown on a timeline as follows.

Allocating these costs over the useful life also means that the organization is not recording a huge expense of $515,000 in Year 1 which would result in skewing up the operational results in that year.

Allocating these costs over the useful life also means that the organization is not recording a huge expense of $515,000 in Year 1 which would result in skewing up the operational results in that year.

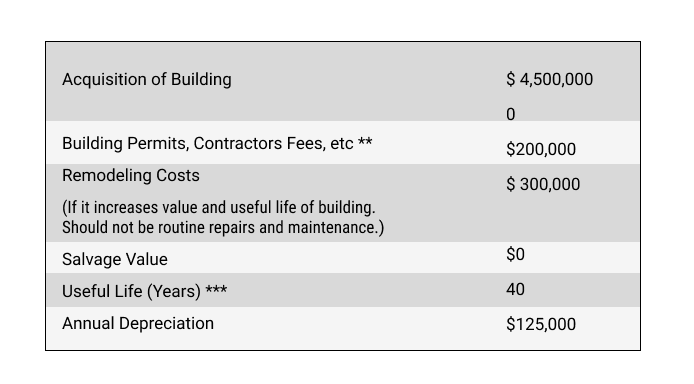

Let’s take another example on calculation of depreciation on acquisition of property.

**Since costs of acquiring a tangible capital asset includes the costs necessary to bring the asset to a condition and location necessary for its intended use, activities such as development of plans or the process of obtaining permits from governmental authorities, environmental studies could also be included as a cost necessary to bring it a condition and location necessary for its intended use.

**Since costs of acquiring a tangible capital asset includes the costs necessary to bring the asset to a condition and location necessary for its intended use, activities such as development of plans or the process of obtaining permits from governmental authorities, environmental studies could also be included as a cost necessary to bring it a condition and location necessary for its intended use.

*** Useful life is an estimate by the management. Typically, nonprofit organizations depreciate buildings over 40 years (could be influenced by IRS rules on depreciation – for IRS publication on depreciation click here.

Based on the above, this organization would need to record an annual depreciation expense of $125,000 over a period of 40 years.

While discussing depreciation, it is also important to talk about Capitalization Policy. Management should set what is known as a Capitalization policy. The Capitalization policy sets a threshold, above which expenditures are recorded as fixed assets (therefore should be depreciated) and below which are charged to expenses in the year that the expenses are incurred.

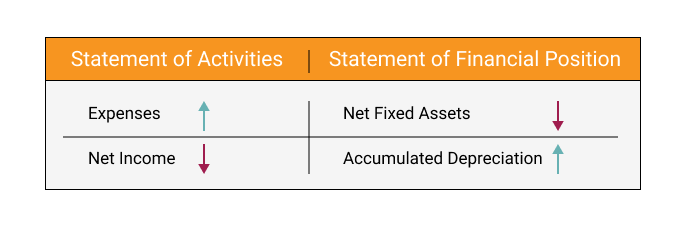

Impact on financial statements

The impact of depreciation on the Statement of Activities (P&L) and the Statement of Financial Position (Balance Sheet) is as follows.

Depreciation results in reduction of net taxable income and results in lower taxes. But since nonprofits are not taxed, taxation related benefits of depreciation are not addressed here.

Depreciation results in reduction of net taxable income and results in lower taxes. But since nonprofits are not taxed, taxation related benefits of depreciation are not addressed here.

Impact of depreciation on business model

Now that we have covered the technical aspects, let’s discuss how depreciation impacts cost recovery in your business model. The most critical step in creating a sound, financially sustainable business model is knowing the true cost or full cost of your programs.

All organizations have direct costs and indirect costs. Direct costs are costs that are directly related to a program. For example, if you are operating a food pantry, food supplies, salaries and benefits of the Program Supervisor running the program are all considered direct costs. Then there are the indirect costs for running the program. These would be all other expenses incurred by the organization which are necessary for the functioning of the organization such as occupancy expenses, insurance, salaries of administration and support staff. To know the true cost of running a program, a portion of the indirect costs such as salaries of support staff such as finance, HR, etc. need to be allocated to these programs as well.

Depreciation is a cost that can either be a direct cost or indirect cost. Depreciation directly related to the Program delivery, for instance, depreciation on a van that is exclusively used for meal delivery can be included as direct cost. It can also be included as indirect cost allocable to the program, for instance, depreciation on property out of which the program is being implemented.

Therefore, having a depreciation expense in your budget can lead to recovery of ‘more’ costs when you are funded through foundation grants, government contracts. Including these costs in your program budgets would ensure that you are recovering your costs through the contracts/ grants. If you were to not have depreciation as a line item in your budget, you would not be able to recover it and hence leave valuable $$$ at the table.